Distinctively designed for Banks & micro-financial organizations, EasyBankCore® can help financial organizations to:

- Achive Corporate, Retail & Investment Banking Functions with ease

- Remain in compliance with central banks & government regulations

- Keeping pace with latest technologies

- Handle future growth and go-to-market strategy

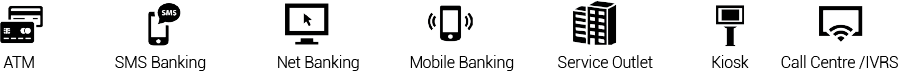

- Make more informed cost-effective decisions relating to customers, services & integrating additional delivery channels like SMS Banking, Net Banking, Mobile Banking, Payment Gateways, POS, IVRS, Settlement Systems, Handhelds, Self Service Kiosk, Digital API Integration & enabling 24/7 banking.

- To address key security concerns like secure authentication , multi-level authorization, data encryption for Data-in-Motion & Data-at-Rest , User Role based Access with 2FA , PII data privacy.

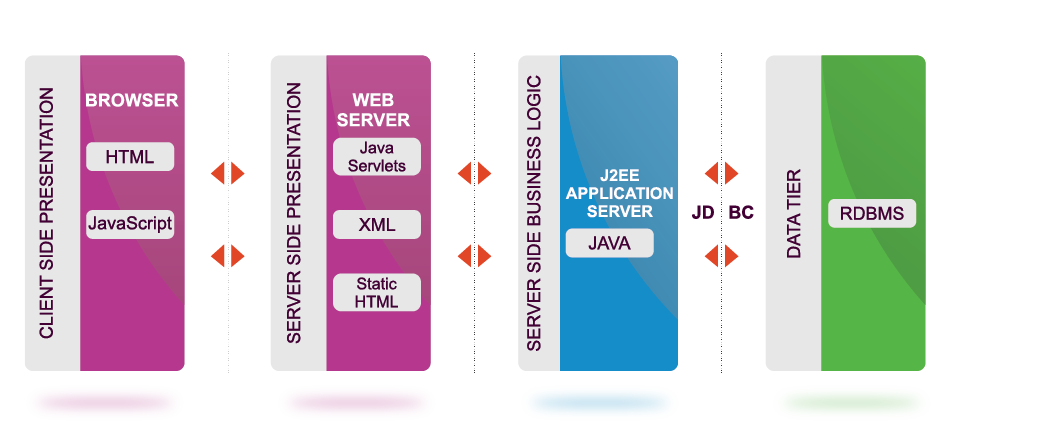

EasyBankCore® is a set of robust functional component that support a wide range of business function within the Digital Banking Environment.

Platform-Server(OS)

- Oracle Enterprise Linux

- Red Hat Enterprise Linux

- HP-UX

- Microsoft Windows®

Application Server

- JBoss

- WildFly

Front End

- Javascript

- HTML

- AJAX

Client (OS)

- Windows® XP Thin Client

- Windows 7,8,10.

Architecture

- N-Tier(Browser Based)

- Microservices

Back End

- Oracle 11g Release 2 & Higher

Digital Channels

Interfaces

| Payment Gateway | Next Gen- RTGS/NEFT Converter | Digital API Management | Personalized Cheque Book |

|---|---|---|---|

| XBRL/ADF | Application Supported by Blocked Amount (ASBA) | National Automated Clearing House (NACH) | ATM HOST ISO 8583 UPI2.0 Compliant |

| e-KYC , CKYC, CIBIL | Fraud & Risk Management(FRM) with BASEL III Compliance | Bharat Bill Payment System | Treasury Management |

Core Modules

| Customer Information Management | CASA | Term Deposits | Agricultural Advances(DCCB Specific) |

|---|---|---|---|

| Bank Guarantee | Trade Finance | Loan Disbursements | Repayment Schedule | Standing Instructions |

| NPA Management | Floating Rate of Interest | Credit Appraisal with userdefined Document Templates | Imaging Module (Multiple Signature Capturing/Verification) |

| Teller Operations | OSS(1-8) | GST Management | PACS |

| Limits | Credit Risk Management | Share and Dividend Accounting | Recurring Deposits |

| PDC Management | Payroll | Remittance/OBC/IBC | Cash/Liquidity Management |

| Insurance Management | Investment Portfolio Management/Tracking (Treasury, Money Market Back Office etc.) | Parameterized Incidental Service Charge Calculation | Document Management System |

| Banks Account Management & Reconciliation | ALM | Suit File-NPA Recovery(Legal) | Centralized Clearing |

| Flexi-Deposit | Collateral Management | CIB Data Exchange | Gold Loans |

| BI-Dash Board | Audit Trail | Parameterized Interest Calculation | Lockers |

| Stores – Stationery – Inventory Management | Centralized – Internal Audit Management System | E-Circular | Auto Risk Categorization |

| Sweep In/Out Orders | Fixed Assets Management | Next Gen – RTGS/NEFT (STP) | FI(Financial Inclusion) |

Compliance & Reporting

| MIS / DSS | Data Warehousing | AML (CTR, STR , FIU India) |

|---|

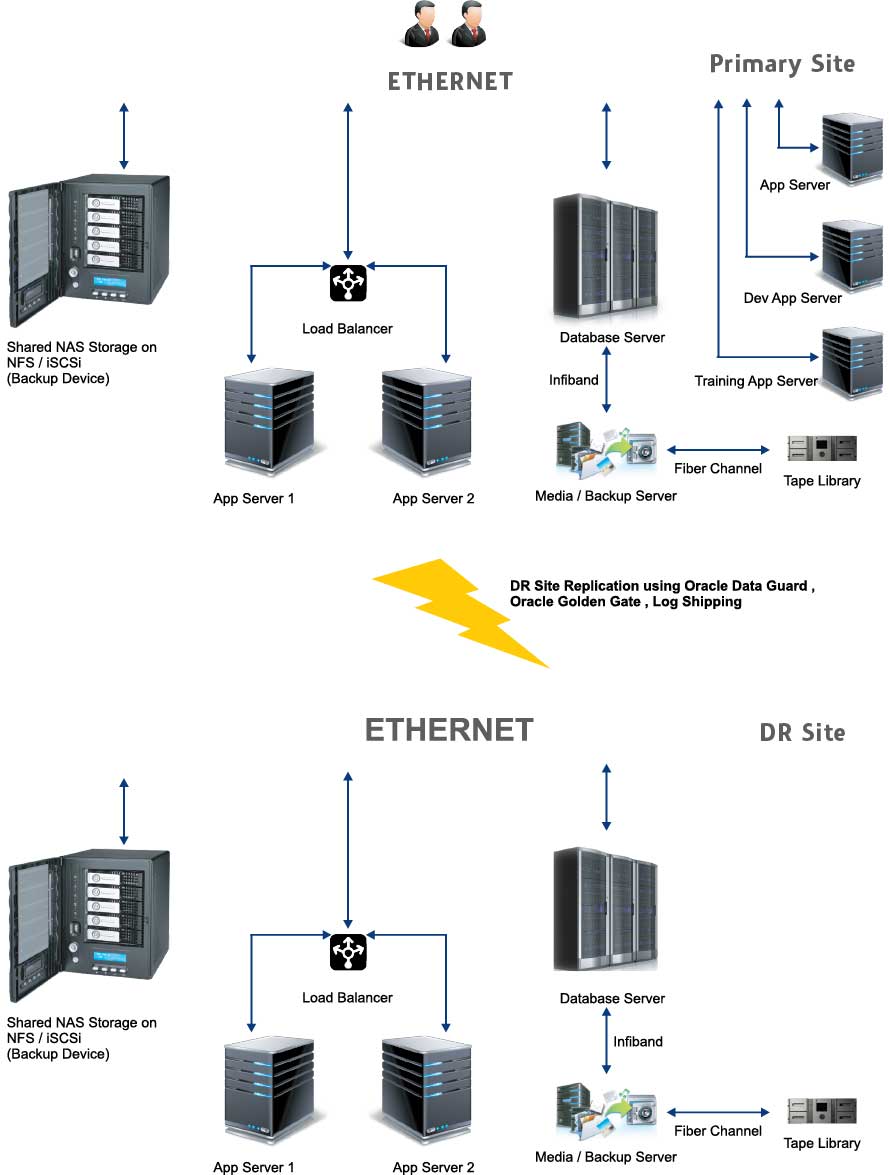

Business Continuity Plan & Disaster Recovery Setup

| Server Virtualization | Network Orchestration | SAN Mirroring | Database Replication |

|---|

- MicroServices/Service Oriented Architecture enables quick deliveries(XML & WebService)

- Multi-Currency Enabled

- Based on 4-Eye Principle & Multi-Level Authorization

- Operates on minimum bandwidth, 6 to 8 kbps Per User

- Sensitive Column Storage in Bcrypt, MD5 & 3DES

- Disaster Recovery Enabled(Real Time Data Replication with Oracle DataGuard/ Golden Gate/ Log Shipping)

- Lowest CPAEX & OPEX amongst competition (Cost Effective yet best-of-the-breed solution)

- Implementation Time crunched by > 75% as compared to competition

- User-Defined Pass Book Formats, Drafts, Share Warrants etc.

- Packaged RBI OSS Reports with no additional costs

- Integrated Scheduler for MIS/DSS

- Bundled with Extract, Transform & Load (ETL) tool

- In-built Report Builder for Ad-Hoc Queries/ Extracts

- Unparalleled Rich GUI & User Friendly Screen designed for Heavy Duty Data Entry & Quicker Operations

- Rich Internet Application (RIA)

- Robust Security Framework

- Supports Two-Factor Authentication

- Multilingual Enabled

- Unmatched Team Experience – Implementation & Support

- Real-Time, On-Line General Ledger

- Flexible Template based System reduces Vendor’s Dependency

- Highly Parameterized System (800+) Parameters Reducing Customization Costs

- PDF Report Generation

- Business Intelligence

- 650+ Reports & Extracts

Business Continuity Plan & Disaster Recovery Infrastructure Management :

Server Virtulization

This is being considered as a very cost effective candidate for DR sites. Instead of having a one-to-one ratio of servers between the primary and DR site, server virtualization allows you to have a one-to-many ratio. Server virtualization allows you to run multiple server applications on the same physical server. Each server application runs on its own desired Operating System, and remains isolated from others. Virtualization software like VMware or Microsoft® Virtual Server make this possible. It creates a virtual layer on a physical server, and let’s you setup all your applications on this layer as different virtual machines. Each virtual machine comprises of one server app with its OS.

Another advantage of using server virtualization is that it makes testing before deployment very easy. Once you’ve created a virtual machine of your main server application, you can create its clone on the same server and test the two for replication and synchronization. Since they’re both on the same physical machine, the testing is faster. Moreover, you can quickly start and stop one virtual machine, which is equivalent of booting up or shutting down. This will allow you to simulate server shutdowns very conveniently. Once you’re satisfied, you can roll it out at the DR site.

Network Orchestration

Acute’s Network orchestration assists network engineers to define their own gateways, routers, and security groups through software configuration files or policies. Orchestration allows networks to scale as needed, enables network services to be provisioned across multiple devices, and it makes it possible to deploy resources as needed, thus making the network more agile and responsive to enterprise software such Core Banking Solution & ERP. Network orchestration is a policy-driven approach to network automation that coordinates the hardware and software components of a software application or service requires to run in a secured & scalable manner. An important goal of orchestration is to securely automate the way network requests are carried out and minimize the human intervention required to deliver an application or service seamlessly.

SAN Mirroring

Using SAN mirroring, any data that is changed on the production site (including the version of software) is copied to a mirrored SAN on the DR site. On the backup site, servers (application as well as database) with configuration identical to the production servers are kept pointing to the mirrored SAN. Thus, if the production site goes down, the DR site assumes the role of the primary and logs all the changes (transaction data, etc) until the primary site is restored. This approach is higher in cost and requirement of bandwidth, but provides for a complete failsafe mechanism for disaster recovery.

Sample Implementation Plan(Core Banking Solution) :

| Activity | Deliverables |

|---|---|

| Infrastructure (Data Centre) hosting and environmental software installation, Setting up Servers, Application Servers, Security Infrastructure setup | Successful installation of Operating System on DB & App. Servers, Network Setup, Security infrastructure and parameter set-up. |

| Conducting gap analysis and System Requirement Specification study | Detailed sign-off customization specification document with Prototypes, Business Validations, Processes etc. |

| Product Customization | Customized version in line with Bank’s requirements |

| Data Migration | Data Migration from the legacy system from day 1 in EasyBankCore® ,vetted by Bank’s team with multiple iterations. |

| System Testing | Detailed Test cases & validations, Load testing after Data Migration |

| UAT Set Up & Final UAT testing | Re-testing of incidents reported if any and Sign-off on successful completion of UAT testing |

| Core Team Training | Provides a foundation & deep understanding of CBS Modules based on T2T Approach |

| Product Customization Release , Fine Tuning of the S/w, DB tuning after Data Migration | Final version Release & Sign off |

| Parallel run with 1 Pilot Branch & Cut Off to Live | Final Modifications as per change request based on actual user experiences |

| Switch over to LIVE Application | Project Sign off |

Benefits of EasyBankCore® (Core Banking Solutions) :

- Integrated modularity: unlike dispersed legacy systems Unified data is available at the right time with the flexibility to choose the optimum set of functional modules.

- Universal banking: gain complete support for retail, commercial, and investment banking.

- Multi-channel seamless delivery: deliver non-stop services for all transactions through multiple delivery channels.

- Low total cost of ownership (TCO): achieve low cost and high performance on an open platform that uses industry-standard and off-the-shelf components.

- Enhanced customer relationships: improve both customer service and retention.

- Reduced operational costs: eliminate coordination problems by deploying enterprise-wide management and control centrally.

- Quick ROI: by reducing the cycle time in information gathering and putting to together manually.

- Enhanced Business Productivity: by automating Daily tasks, so banks can work on creating new avenues in Insurance, Bill Junction , Loan Recovery (Para-Banking) etc.

- Enhanced Capacity: with advent of new technologies at effective prices co-operative banks can weather the challenges posed by nationalized and private banks by providing better services to clients.

- Enhanced Scalability: by adopting new technologies and standards, co-operative banks can adopt to any existing/new RBI guideline quickly with existing personnel with the help of software application. Core banking applications (retail, corporate), delivery channels (ATM, mobile, telephone, Internet, call centre), peripheral applications (credit and market risk, anti-money laundering, treasury, regulatory reporting, cash management, data warehouse, customer relationship management, document management), and transaction switching offers bank to integrate with these multi-delivery channels with ease.

- Secured Data: by switching to new 4GL RDBMS and technologies banks have more Robust, high-availability IT infrastructure with minimum disruption to business.

- Centralization of Authority: instead of maintaining separate Data Bases and executables at each Branch, EDP members can efficiently manage /maintain the System from a Centralized Location with consistency of operations.

- Compliance & Bank Regulators: EasyBankCore® produces the required reports for compliance & regulatory bodies like the OSS , CCR , STR , financial statements, asset and liability reports, NPA reports, large currency transaction reports etc. All produced by either the deposits, or the loan or a combination of deposit, loan and G.L. System.